#Return on debt fund investments

Explore tagged Tumblr posts

Text

#zinc income fund#income fund#Return on debt fund investments#Real Estate Income Funds#fixed income investment#passive income opportunities#Income fund investment for beginners#passive income fund investments#income fund investment strategy#Retirement Income Funds#Safe Investments for Retirement#mortgage investment#Mortgage Funds#Best Income Funds for Retirees

0 notes

Text

Generally speaking, here are the order of financial priorities:

Build an emergency savings of at least 3 months worth of living expenses

Pay down all high-interest debts, such as credit card debts

Build an emergency savings of 6 months - year worth of expenses.

Place some of your savings in a high-yield savings account (or money market fund) that you can still access easily without penalty if you need that money.

Start considering investing in something that yields a higher rate of return, but requires that you let money just *sit* in that investment for months or years at a time (CDs/bonds/index funds/a 401k [which is really just a type of index fund usually]).

Learn how to let your investments just sit without constantly looking at them or worrying about them! This is a skill that requires time, practice, and sometimes research to develop.

As your circumstances change and your familiarity and comfort with investing grows, tweak your exact investment strategy as needed. (For example, shift some money from index funds to bonds as you get older, or move CD investments to stocks as interest rates go down).

438 notes

·

View notes

Text

Things Biden and the Democrats did, this week. #6

Feb 16-23 2024

The EPA announced 5.8 billion dollars in funding upgrade America's water systems. 2.6 billion will go to wastewater and stormwater infrastructure, while the remaining $3.2 billion will go to drinking water infrastructure. $1 billion will go toward the first major effort to remove PFASs, forever chemicals, from American drinking water. The Administration all reiterated its plans to remove all lead pipes from America's drinking water systems, its spent 6 billion on lead pipe replacement so far.

The Department of Education announced the cancellation of $1.2 billion in student loan debt reliving 153,000 borrowers. This is the first debt cancellation through the Saving on a Valuable Education (SAVE) Plan, which erases federal student loan balances for those who originally borrowed $12,000 or less and have been making payments for at least 10 years. Since the Biden Administration's more wide ranging student loan cancellation plan was struck down by the Supreme Court in 2023 the Administration has used a patchwork of different plans and authorities to cancel $138 billion in student debt and relieve nearly 4 million borrowers, so far.

First Lady Jill Biden announced $100 million in federal funding for women’s health research. This is part of the White House Initiative on Women’s Health Research the First Lady launched last year. The First Lady outlined ways women get worse treatment outcomes because common health problems like heart attacks and cancer are often less understood in female patients.

The Biden Administration announced 500 new sanctions against Russian targets in response to the murder of Russian dissident Alexei Navalny. The sanctions will target people involved in Navalny's imprisonment as well as sanctions evaders. President Biden met with Navalny's widow Yulia and their daughter Dasha in San Francisco

The White House and Department of Agriculture announced $700 Million in new investments to benefit people in rural America. The projects will help up to a million people living in 45 states, Puerto Rico, and the Northern Mariana Islands. It includes $51.7 million to expand access to high-speed internet, and $644.2 million to help 158 rural cooperatives and utilities provide clean drinking water and sanitary wastewater systems for 578,000 people in rural areas.

The Department of Commerce signed a deal to provide $1.5 billion in upgrades and expand chip factories in New York and Vermont to boost American semiconductor manufacturing. This is the biggest investment so far under the 2022 CHIPS and Science Act

the Department of Transportation announced $1.25 billion in funding for local projects that improve roadway safety. This is part of the administration's Safe Streets and Roads for All (SS4A) program launched in 2022. So far SS4A has spent 1.7 billion dollars in 1,000 communities impacting 70% of America's population.

The EPA announced $19 million to help New Jersey buy electric school buses. Together with New Jersey's own $45 million dollar investment the state hopes to replace all its diesel buses over the next three years. The Biden Administration's investment will help electrify 5 school districts in the state. This is part of the The Clean School Bus Program which so far has replaced 2,366 buses at 372 school districts since it was enacted in 2022.

Bonus: NASA in partnership with Intuitive Machines landed a space craft, named Odysseus, on the moon, representing the first time in 50 years America has gone to the moon. NASA is preparing for astronauts to return to the moon by the end of the decade as part of the Artemis program. All under the leadership of NASA Administrator, former Democratic Senator and astronaut Bill Nelson.

#Thank Biden#Joe Biden#student loans#student loan forgiveness#climate change#climate crisis#Russia#Alexei Navalny#women's health#NASA#odysseus#moon landing#good news#Democrats#Politics#us politics

714 notes

·

View notes

Text

How the Biden-Harris Economy Left Most Americans Behind

A government spending boom fueled inflation that has crushed real average incomes.

By The Editorial Board -- Wall Street Journal

Kamala Harris plans to roll out her economic priorities in a speech on Friday, though leaks to the press say not to expect much different than the last four years. That’s bad news because the Biden-Harris economic record has left most Americans worse off than they were four years ago. The evidence is indisputable.

President Biden claims that he inherited the worst economy since the Great Depression, but this isn’t close to true. The economy in January 2021 was fast recovering from the pandemic as vaccines rolled out and state lockdowns eased. GDP grew 34.8% in the third quarter of 2020, 4.2% in the fourth, and 5.2% in the first quarter of 2021. By the end of that first quarter, real GDP had returned to its pre-pandemic high. All Mr. Biden had to do was let the recovery unfold.

Instead, Democrats in March 2021 used Covid relief as a pretext to pass $1.9 trillion in new spending. This was more than double Barack Obama’s 2009 spending bonanza. State and local governments were the biggest beneficiaries, receiving $350 billion in direct aid, $122 billion for K-12 schools and $30 billion for mass transit. Insolvent union pension funds received a $86 billion rescue.

The rest was mostly transfer payments to individuals, including a five-month extension of enhanced unemployment benefits, a $3,600 fully refundable child tax credit, $1,400 stimulus payments per person, sweetened Affordable Care Act subsidies, an increased earned income tax credit including for folks who didn’t work, housing subsidies and so much more.

The handouts discouraged the unemployed from returning to work and fueled consumer spending, which was already primed to surge owing to pent-up savings from the Covid lockdowns and spending under Donald Trump. By mid-2021, Americans had $2.3 trillion in “excess savings” relative to pre-pandemic levels—equivalent to roughly 12.5% of disposable income.

So much money chasing too few goods fueled inflation, which was supercharged by the Federal Reserve’s accommodative policy. Historically low mortgage rates drove up housing prices. The White House blamed “corporate greed” for inflation that peaked at 9.1% in June 2022, even as the spending party in Washington continued.

In November 2021, Congress passed a $1 trillion bill full of green pork and more money for states. Then came the $280 billion Chips Act and Mr. Biden’s Green New Deal—aka the Inflation Reduction Act—which Goldman Sachs estimates will cost $1.2 trillion over a decade. Such heaps of government spending have distorted private investment.

While investment in new factories has grown, spending on research and development and new equipment has slowed. Overall private fixed investment has grown at roughly half the rate under Mr. Biden as it did under Mr. Trump. Manufacturing output remains lower than before the pandemic.

Magnifying market misallocations, the Administration conditioned subsidies on businesses advancing its priorities such as paying union-level wages and providing child care to workers. It also boosted food stamps, expanded eligibility for ObamaCare subsidies and waved away hundreds of billions of dollars in student debt. The result: $5.8 trillion in deficits during Mr. Biden’s first three years—about twice as much as during Donald Trump’s—and the highest inflation in four decades.

Prices have increased by nearly 20% since January 2021, compared to 7.8% during the Trump Presidency. Inflation-adjusted average weekly earnings are down 3.9% since Mr. Biden entered office, compared to an increase of 2.6% during Mr. Trump’s first three years. (Real wages increased much more in 2020, but partly owing to statistical artifacts.)

Higher interest rates are finally bringing inflation under control, which is allowing real wages to rise again. But the Federal Reserve had to raise rates higher than it otherwise would have to offset the monetary and fiscal gusher. The higher rates have pushed up mortgage costs for new home buyers.

Three years of inflation and higher interest rates are stretching American pocketbooks, especially for lower income workers. Seriously delinquent auto loans and credit cards are higher than any time since the immediate aftermath of the 2008-09 recession.

Ms. Harris boasts that the economy has added nearly 16 million jobs during the Biden Presidency—compared to about 6.4 million during Mr. Trump’s first three years. But most of these “new” jobs are backfilling losses from the pandemic lockdowns. The U.S. has fewer jobs than it was on track to add before the pandemic.

What’s more, all the Biden-Harris spending has yielded little economic bang for the taxpayer buck. Washington has borrowed more than $400,000 for every additional job added under Mr. Biden compared to Mr. Trump’s first three years. Most new jobs are concentrated in government, healthcare and social assistance—60% of new jobs in the last year.

Administrative agencies are also creating uncertainty by blitzing businesses with costly regulations—for instance, expanding overtime pay, restricting independent contractors, setting stricter emissions limits on power plants and factories, micro-managing broadband buildout and requiring CO2 emissions calculations in environmental reviews.

The economy is still expanding, but business investment has slowed. And although the affluent are doing relatively well because of buoyant asset prices, surveys show that most Americans feel financially insecure. Thus another political paradox of the Biden-Harris years: Socioeconomic disparities have increased.

Ms. Harris is promising the same economic policies with a shinier countenance. Don’t expect better results.

#Wall Street Journal#kamala harris#Tim Walz#Biden#Obama#destroyed the economy#america first#americans first#america#donald trump#trump#trump 2024#president trump#ivanka#repost#democrats#Ivanka Trump#art#landscape#nature#instagram#truth

166 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Investing for Beginners

Fundamentals of investing:

What’s the REAL Rate of Return on the Stock Market?

Do NOT Make This Disastrous Beginner Mistake With Your Retirement Funds

The Dark Magic of Financial Horcruxes: How and Why to Diversify Your Assets

Dafuq Is Interest? And How Does It Work for the Forces of Darkness?

Booms, Busts, Bubbles, and Beanie Babies: How Economic Cycles Work

When Money in the Bank Is a Bad Thing: Understanding Inflation and Depreciation

Investing Deathmatch series:

Investing Deathmatch: Managed Funds vs. Index Funds

Investing Deathmatch: Traditional IRA vs. Roth IRA

Investing Deathmatch: Investing in the Stock Market vs. Just… Not

Investing Deathmatch: Stocks vs. Bonds

Investing Deathmatch: Timing the Market vs. Time IN the Market

Investing Deathmatch: Paying off Debt vs. Investing in the Stock Market

Investing Deathmatch: What Happens in a Bull Market vs. a Bear Market

Now that we’ve covered the basics, are you ready to invest but don’t know where to begin? We recommend starting small with micro-investing through our partner Acorns. They’ll round up your purchases to the nearest dollar and invest the change in a nicely diversified portfolio of stocks, bonds, and ETFs. Easy as eating pancakes:

Start saving small with Acorns

Alternative investments:

Small Business Investing: A Kinder, Gentler Alternative to the Stock Market

Bullshit Reasons Not to Buy a House: Refuted

Investing in Cryptocurrency is Bad and Stupid

So I Got Chickens, Part 1: Return on Investment

Twelve Reasons Senior Pets Are an Awesome Investment

How To Save for Retirement When You Make Less Than $30,000 a Year

Understanding the stock market:

Ask the Bitches Pandemic Lightning Round: “Did Congress Really Give $1.5 Trillion to Wall Street?”

Season 3, Episode 2: “I Inherited Money. Should I Pay Off Debt, Invest It, or Blow It All on a Car?”

Money Is Fake and GameStop Is King: What Happened When Reddit and a Meme Stock Tanked Hedge Funds

Season 3, Episode 7: “I’m Finished With the Basic Shit. What Are the Advanced Financial Steps That Only Rich People Know?”

Wait… Did I Just Lose All My Money Investing in the Stock Market?

Season 4, Episode 1: “Index Funds Include Unethical Companies. Can I Still Invest in Them, or Does That Make Me a Monster?”

Retirement plans:

Dafuq Is a Retirement Plan and Why Do You Need One?

Procrastinating on Opening a Retirement Account? Here’s 3 Ways That’ll Fuck You Over

How to Painlessly Run the Gauntlet of a 401k Rollover

Ask the Bitches: “Can I Quit With Unvested Funds? Or Am I Walking Away From Too Much Money?”

Workplace Benefits and Other Cool Side Effects of Employment

You Need to Talk to Your Parents About Their Retirement Plan

Season 4, Episode 5: “401(k)s Aren’t Offered in My Industry. How Do I Save for Retirement if My Employer Won’t Help?”

Got a retirement plan already? How about three or four? Have you been leaving a trail of abandoned 401(k)s behind you at every employer you quit? Did we just become best friends? Because that was literally my story until recently. Our partner Capitalize will help you quickly and painlessly get through a 401(k) rollover:

Roll over your retirement fund with Capitalize

Recessions:

Season 1, Episode 12: “Should I Believe the Fear-Mongering about Another Recession?”

There’s a Storm a’Comin’: What We Know About the Next Recession

Ask the Bitches: How Do I Prepare for a Recession?

A Brief History of the 2008 Crash and Recession: We Were All So Fucked

Ask the Bitches Pandemic Lightning Round: “Is This the Right Time To Start Investing?”

#investing#how to invest#stock market#finance#personal finance#investing in stocks#retirement fund#retirement account#investing for beginners#investing 101

310 notes

·

View notes

Note

So Webtoons is getting sued by a bunch of law firms in class action lawsuit. Saw it on reddit. Apparently they lied to shareholders about revenue which is like one of the worst things I could imagine doing to your shareholders. Then their stock dropped again. Wow....wonder how this is gonna effect readers going forward or how they're gonna be more exploitative in the future. Not saying the down of Webtoons has begun but I wonder if it's gonna be the start of it.

Yep, I've been following this since the initial investigations began.

All that said, we likely won't see anything of this for a while, if anything even comes of it. The reality is that Webtoons... really didn't actually lie about being bad at making money. It's literally outlined in their IPO documentation:

So these lawsuits, at least in my opinion (*I AM NOT A LAWYER NOR AM I ANYONE WHO HAS ANY EXPERIENCE PLACING WALL STREET BETS, TAKE WHAT I HAVE TO SAY WITH MOUNTAINS OF SALT) is less about Webtoons 'lying' to shareholders and more so about them kicking the debt down the road which these lawyers want to try and hold them accountable for. It's not uncommon for startups to seek out private and/or public funding to help them stay out of bankruptcy, but such practice is incredibly shitty because if a company was already near the point of bankruptcy to begin with, what exactly is going to change to ensure that they actually make that money back with an additional net gain for those investors?

So in that sense, either something will come of this, or it won't, nothing's really a guarantee as of now. It's just as common for startups seeking public investments to get sued within their first 1-2 years because a company not returning on their initial investments within 3-6 months is a prime cut for lawyers to drool over. Despite their attempts to be honest about their earnings, the vast majority of Wall Street investors are paranoid little fuckers who invest in whatever's new and exciting with the hopes that it'll turn them a profit quickly and without headache. Unfortunately, Webtoons isn't a company that's known for having huge profit margins, which these investors would have realized if they knew anything about this industry or at the very least, bothered to read the fine print that Webtoons was obligated to lay out for them in their documentation. At best the majority of them saw Webtoons' offering that covered buzzwords like "content generation" and "AI" and went "yes please, I love money!" without realizing that webtoons, as a medium, have some of the highest production expenses to lowest-paying demographics out there and therefore companies like Webtoons aren't going to be a short-term gratification. It's more like waiting it out for the "next big thing" that will make that stock valuable again, a massive gamble that isn't guaranteed to payoff. And that's just the game of Wall Street in general.

That said, it's because of how difficult it is to directly monetize digital comics that Webtoons often has to rely on selling merchandise and IP rights in the hopes they'll land a whale - but even their pre-existing whales like Lore Olympus and Let's Play have either nothing to show for themselves, or have left the platform entirely. Of course, they'll vaguely claim that two of Netflix's highest-performing projects came from their platform, but any peek at an aggregated Top 10 list will prove that that is simply not true, and at best, they're referring to True Beauty's live action adaption, which is simply not even close to breaching that list of all-time top-performers (except probably in Korea but this is Goldman Sachs and their American investors they're trying to convince), All of Us are Dead (see above, same situation as True Beauty), and Heartstopper which is... not even an Originals series. Of course, that didn't stop Webtoons and Tapas from boasting about Heartstopper's Netflix adaption and its success on the platform, but literally none of its success is exclusively owed to either of those platforms, Alice Oseman flies solo and if anything, Heartstopper never would have gotten to the point it's at if it were tied down to a Webtoon Originals contract.

So in a sense, until anything comes of these lawsuits, they're more so just lawyers jumping on their own investment opportunity - the opportunity to get settlements from Webtoons for both their clients and themselves by extension. At best what they feasibly have against Webtoons is the company getting way too high on their own supply without anything to feasibly show in terms of profit for their IP's. Considering how many IP's they sold to television and film production studios back in 2019-2022 when they were at their peak over the lockdowns - a peak that is long in the rearview mirror - they are incredibly behind in actually paying off those promises. Even in a recent meeting they held just the other day with Goldman Sachs, they're quoted as saying: "When Rachel Smythe was a graphic designer in New Zealand, 4 or 5 years ago, and she had a story to tell, we enabled her to not just tell it in one part of the world, but globally. She became a NYT Bestselling author, she is rumored to be releasing soon as a major animated release."

When even the company that hosts Lore Olympus as its prize pig can only say that its long-anticipated TV production that both Rachel and Webtoons have been assuring people on repeat that the show is "still happening" and that what they've seen so far "looks amazing" is simply 'rumored to be releasing soon'... I don't even have the words to describe how embarrassing that is for them. Never mind the fact that Lore Olympus has been over for months and both it and its creator, Rachel, have been falling into the pits of irrelevancy. They don't have any other home-runners to bet on, they're just continuing to bank on Rachel as their own example of someone who "got big" even though it was years ago and that fame is now shrinking with the passage of time, you can even see the performance of the series dipping in its own front-end metrics over time. They are trying so hard to convince people that they're worth investing in when the one thing that actually DID have that kind of allure has now come and gone.

Never mind the fact that again, most Wall Street investors probably don't even participate in webtoon culture so the name "Rachel Smythe" isn't some golden ticket to fortune. Lore Olympus might get a bit more of a reaction, but it's going to be a lot more mixed due to how divisive the series became in the end, and general audiences who are new to Webtoons as a public company (and the medium as a whole) are still not so likely to know what the fuck that means or why it's significant. The best time to pull the "we have Rachel Smythe!" card in the public investing pool was, like many other things Webtoons has fallen behind in, years ago. Now it's clear Webtoons thinks that Rachel is their own personal J.K. Rowling, but they forgot the part where Rachel is creating for an incredibly niche and historically unprofitable medium that is nowhere near as big as what Harry Potter was back in its prime, and - personally speaking - that Rowling and Rachel are both, well... terrible at what they do.

Webtoons also has the added burden of not being a startup company. They're not some grassroots Silicon Valley tech startup run by a bunch of friends "with a dream", they're an extension of an industry that thrives overseas but barely has any infrastructure to support it here. They've been bankrolled for years by an overseeing tech company - Naver - but have consistently failed to get out of the red and so of course, now they're turning to public investments to help them out and subsequently, are passing that debt off to the next highest bidder, which is Wall Street. They had nearly a decade to figure their shit out here in the West and while they had their opportunities to thrive, those opportunities have come and gone, a lot of doors have closed and now this all feels like their own attempts to rip those doors back open again.

There is a LOT to insinuate already that Webtoons - a Korean-hosted platform - wasn't ready to enter the Western market and this fumbling of their public stock image is yet another great example of that. Even outside of Webtoons, other Korean-run platforms like Tapas have relied on private investments to keep them afloat (and still do, Tapas is still operating privately) and have routinely struggled to get a real foothold in the greater Western industry despite how much they hyped themselves up as the "next big thing". They're all playing the same game over and over again expecting better scores even though the playing fields are entirely different than what they've come to expect in Korea, where much of the entertainment industry is built around webtoons, much like how our entertainment industry in the West is built around comic giants like Marvel and DC (and even those giants are faltering as we've been seeing over the past several years).

Anyways. I don't know if this lawsuit is gonna go anywhere, there's a lot to the legal process that could lead to a variety of different outcomes, but at the very least, their plummeting stock value and the lawyers circling them from above is yet another notch on their belt of fuck-ups over the past few years. I know it's easy to say this in hindsight and I'm not the kind of guy to say "I told you so", but considering I've been following along with the bullshit of these major platforms for years and knew as soon as Webtoons was rumored to be going forward with an IPO that it would lead to disaster, I'm pretty confident in saying, "No really, I told you so." And I don't entirely blame the investors for that (except for the ones that clearly didn't read the fine print) - I also blame Webtoons for that, because they are a chronically unprofitable company run by a bunch of clowns who manufactured their own demise by getting in WAY over their heads and clearly don't even have a concept of a plan let alone an actionable one.

And that sucks, because the people who stand to get hurt the most are the ones who were made those empty promises years ago, long before the platform entered Wall Street - and that's the creators who were promised that their livelihoods would be secured and their work would be protected.

I will forever bully and make fun of Webtoons for everything they've done in and to this industry. I hope at the very least those investors learned an expensive lesson, and that the damage these lawsuits have already caused to Webtoons' public image - regardless of whether or not these lawsuits win - empowers others who have been screwed over by them to speak up and make their moves. They are not a monolith. They are a brittle business operating from the trunk of a clown car on their way to becoming a penny-stocks sham.

Fuck Webtoons <3

54 notes

·

View notes

Text

Warnings: Incest.

Sarah stared at the god awful wallpaper that was all over the dining room. Rose chose it. She changed most things when she moved in. Her taste was terrible compared to her mother's. All the warmth in Tannyhill disappeared the moment Rose moved in. Sarah wanted it back. She wanted to make it her home again.

Their home.

They had money now, and Rafe had left her in charge to redecorate. Had given her a small portion of their cut to make Tannyhill more homely. The rest was either kept in a safe place or invested in something to get more money out of it. They wanted to keep their previous lifestyle, and for that they needed the money to keep coming. They invested in something safe, and not too much more than the minimum. They had to be smart about it.

Rafe had wanted to use some of it to pay the debts that were all over Cameron Development, but Ward had signed the company over to Rose. Some sort of revenge for their betrayal. It was almost better that way, so they could star over. Besides, with their share of the gold and Rafe starting the process to access the fund left to them by their mother they didn't need anything from Ward. The Redfields had been the richest family on Kildare, and their mother was the last of them so everything went to her. And now that she was dead, everything went to her children.

The only bad thing was that it was taking a little too long, they weren't supposed to have it until Rafe turned twenty-four. Because he was supposed to go to college. Well, he did go to college, but he dropped out the first year. Another thing Rafe didn't like to talk about.

There were so many things he didn't like to talk about.

Like what happened in the Bahamas. The kiss. When Rafe kissed her. When she liked it. They returned home and they didn't talk about it. The summer ended and they didn't talk about it. Christmas passed and they didn't talk about it. But Sarah couldn't stop thinking about it. Every time he kissed her forehead or her cheek, every time he smiled at her, every time he hugged her she thought about it. Did Rafe think about it too? Did that kiss haunted him as it her? Or had he forgotten about it?

No.

He hadn't, she knew that. They slept in the same room, the same bed, and sometimes he murmured her name in dreams. She probably did the same, all things considered. But that was wrong. It should disgust her. They were siblings, they couldn't be together that way. They couldn't. No matter how much she wanted it, or how much Rafe may want it. So maybe it was better if they never talk about it. If the kiss just stayed forever undiscussed.

It's for the best.

With a sigh, Sarah wrote down the word wallpaper on her list. It was a list of things to buy for the house. It was pretty long already.

"What about a bigger couch?" suggested Wheezie from the other side of the table "The one we have is too small for the three of us, and it's also kinda ugly"

"Yeah, a couch"

Wheezie wrote it down on her own list, with one of her glitter pens.

"I don't really remember how it used to be" she commented sadly "I was like four when Rose began changing everything. How did mom have everything? There isn't many pictures of the house before"

"There are some, but they're up in the attic" she put down her own pen "Mom had it all very homely, like one of those Christmas commercials" she smiled at the memory of the fireplace and the lush carpets all over the floors "There were pictures of mom's ancestors over the walls, pictures of the house in the past. We were always running around, she didn't mind, unlike Ward. She used to organize parties during the summer nights and had her clubs coming over in winter"

Elizabeth Redfield was a member of the high society of South Carolina. People in the Outer Banks fought to befriend her, to be part of her book club or her painting club.

"Sounds so cool"

"It was. I'm thinking of putting the old pictures back on the wall and pictures of mom too"

Rose took everything down the moment she became 'Mrs Cameron'. Every trace of Elizabeth Redfield. Rafe and her kept some pictures of her in their rooms, but most was up in the attic.

"That's a great idea" Rafe appeared in the room. She had to turn her head to look at him "Yeah, let's do that. I've been thinking about it myself. 'Bout mom's old room. I think I'm gonna move there"

Their mother's room, not Ward's and Rose's, but the main bedroom of Tannyhill. No one had used it since her death. Rose hadn't wanted to sleep where their mother used to, so Ward and her took another room. Now Rafe wanted that one. The biggest room in the house.

"Oh?" did that meant he wasn't going to sleep with her anymore.

"Don't worry, you can come in any time"

Sarah smiled and rolled her eyes. She probably would put part of her clothes on that wardrobe, it was the biggest one. Wait...was he suggesting to make it their room?

"You two are weird" Wheezie wrinkled her nose and picked up her phone "Tomorrow after class I'm going to Sandra's. We're celebrating the last year of middle school"

"Not sure why you're celebrating that, high school is a nightmare"

"I don't really remember high school" Rafe squeezed Sarah's shoulder "Anyway, I got shit to do. It's time for bed, Wheez"

Wheezie frowned "I'm not a child, Rafe. I can go to bed when I want to, I'm almost fourteen"

"No, you go to bed when your legal guardian tells you to. Go"

"Ugh. You're no fun anymore"

"That's so rude" Rafe's hand wrapped around her neck, not squeezing or pressing, just lingering there. Sarah's heartbeat raced. Why? It was just her brother showing his care for her "Wanna come to bed?"

Her eyes widened, did she hear right?

"What?"

"To sleep, Sarah" he smirked, lifting his hand from his grip around her neck "What else would it be? I'm gonna hit the shower"

Sarah did the same, taking a shower in her bedroom's bathroom. Not even the hot water seemed to be able to erase the tingle on her neck were Rafe had wrapped his hand around.

She should sleep in her bed tonight, should stay away from Rafe. She didn't. She went straight to his room, to his bed. Rafe was still in the shower, he usually took his time. Or, jerking off. He didn't sleep around anymore, not like before. He never brought girls to Tannyhill and he never stayed the night somewhere else. It had been a couple of months since he had sex. That she knew, at least. So he was definitely jerking off. And who was in his mind while he did it? Maybe her.

No.

No, not her. She was his sister. He wouldn't think about her. That was wrong.

Like the kiss?

Rafe smiled when he saw her, right after he left the bathroom. He was clothed. Thank God. He laid next to Sarah, and hugged her close to his chest. It was always so easy to sleep like that. So easy to sleep with him. It always had been.

Rafe drove her to high school. Not Kildare Academy, no, but the local high school. She had quit the Kook Academy before summer ended and enrolled into the local high school. It was better that way. The kooks kept on gossiping about Ward, about her family, and they wouldn't receive her with open arms. They chose Topper's side after the breakup. So she went to Pogue School (that was what the kooks called it), because at least there she had actual friends.

The situation with the Pogues was better now that they had the gold. Even with John B things weren't terrible. He still wanted to get back with her, according to Kie, but hadn't made a move yet. Sarah hoped he never did. She really didn't want to hurt his feelings again.

"See you later" Sarah kissed his cheek and left the car "Kie is coming later to the pool. Did I told you that already?"

"No. The pool, really? It's winter"

"It's hot" she shrugged.

"That's the global warming" Kie joined her at the gates of the school, standing by her side as she nodded towards Rafe "Hey, Rafe"

They were cordial now, more than before.

"Hey, Kie" he greeted back "Guess I'll pick you up after school then. Bye girls!"

A slight smile decorated Sarah's face while she watched him drive away.

"How was the weekend?" Kiara asked, intertwining their arms as they walked to the door "Mine was insane, I mean, my parents are constantly on my ass lately. I can't believe that after all of it, everything with the gold, they still think I'm lying to them. Can you believe that?"

Anna and Mike Carrera were known for disliking Kie's friendships, they had always criticized her decision to befriend JJ, John B and Pope. They only liked Sarah, but that was because she was a kook and they thought she was a good influence on Kie. She really wasn't, but they didn't need to know that.

"Not to judge your parents or anything, but they are kinda classist"

"Yeah..." Kie accepted a little deflated "I can believe that from my mom, 'cause you know, she has always been a kook. But my dad? He was a pogue. He grew up on the Cut. I don't understand how can he act like that with JJ and John B, and shit, even Pope. And it's Pope, you know? Everyone knows he's good"

Sarah nodded along to her words.

"Who's good?" Sarah jumped back when she heard JJ's voice "Me?"

Pope, John B and JJ were walking by their side now. Pope was carrying his backpack and books, while the other two were carrying absolutely nothing.

"You?" John B chuckled "Nah, must be Pope. No one would ever describe us as 'good"'

"Yeah, we are talking about Pope" Sarah nodded "Because honestly you two are what can be described as 'No good'"

"Rude, Miss Cameron"

He had been very angry at her, JJ, when she broke up with John B. He had been even more pissed when she told Rafe about the gold, but now they were cool again. Hell, he was cool with Rafe even. Mainly because Rafe and her helped John B and him to gain the emancipation. So one didn't have to go into the system and the other didn't have his father spending all his money.

"She's not wrong" Pope joked.

"Hey, guys, Kie is coming to Tannyhill later, you wanna come with us?"

"Oh, yes" JJ nodded earnestly "It's really fucking hot lately, I could do with a pool"

"The ocean is right there and it's free. That being said, I'm in too"

"It's Rafe cool with that?" John B shifted, stopping himself before crossing the door.

Sarah thought it was the fact that he stood witness to what happened to Peterkin, the reason John B was so uncomfortable with her brother. Pope and JJ didn't have that problem, nor did Kie. They came over to Tannyhill and spend the afternoons there, sometimes studying, sometimes doing other things. Rafe wasn't particularly bothered by them either, he was nice even. Hell, he even shared his whiskey with them sometimes. Well, he did once, and Pope proceeded to loudly declare he was never having whiskey again. JJ liked it though.

"He usually is"

"Never complains when we go to study. Not even when JJ drinks his whiskey" Pope commented " Are you going to stand there or...?"

"No, no. Let's go to class"

And if the other students whispered things about her father, Sarah pretended not to notice.

The Club was almost completely full at that time of the day. Which wasn't surprising, rich people loved brunches. Especially the trophy wives, they spend the whole they at the Island Club or shopping. Or that was what Rose did most of the times, even though she did have a job and a business of her own. Which was not really her own, but something that Ward gave to her when they were still having an affair. She did manage it, but not on her own. Rose's real estate business was in cahoots with Cameron Development. To no one's surprise. So yeah, she was a trophy wife. And not one who did useful stuff.

Not like his mother. Elizabeth Redfield was always organising galas and charity events. She liked to help people, to help the island. And sure, what she had had been handed to her, she was an heiress, but she still did the work. She still managed her money and gave it to good causes. Unlike Rose.

Rose only drank wine and bought stuff, like every other trophy wife on that damn island.

"You're being weird lately, man" Kelce sipped his margarita. He loved that shit "Like, seriously. I get that you have to step up now that your dad is in prison, but all of this? It's a little too much, man"

Rafe raised an eyebrow. Honestly, he didn't know what Kelce was talking about. It could be so many things.

"What do you mean?"

"Really? Man, I get that you're clean now, but...I mean, how long has it been since you got laid?"

Months.

Nothing since the summer. Since before doing what he did. Since before the crime. And it was not like he didn't have any opportunities, because he did. Especially since he got the the gold. He wished he could say it was part of his efforts to stay sober, but it wasn't. It was because it felt like cheating. It felt wrong, only the thought of sleeping with someone who wasn't—

"A while" he admitted with a nod before taking a bite of his fried eggs "It's one of the pillars of sobriety: celibacy"

He didn't know if it was, but it could be. So far he did more drinking and smoking and managing stuff to keep himself sober. And thinking about his sisters.

"Sucks to be you. Like I'm genuinely feeling sorry for you"

Rafe chuckled "Thanks, man"

He had known Kelce since They were kids. Their mother's were friends. Well, everyone was friends with his mother, and every parents wanted their children to be friends with the son of the Redfield heiress. But Rafe was a difficult child, or so people said. Most kids didn't want to stick around him. He was too creepy, they said, either too quiet or too prone to tantrums. Except for Kelce. Kelce didn't give a shit about how creepy he was. Kelce just wanted to play hide and seek. And then he just wanted to play basketball. And after that he just wanted to go to parties or chill near the pool.

He was a good friend.

"Anytime"

"How's it going with Scarlett? She's still not interested?"

"Oh, shut up" he smiled "She'll come around"

"If you say so"

"So this... celibacy thing, is it forever?"

God, he hoped not.

"No, no. Just until a few months" a year. Two. He had no fucking idea. Until Sarah— "Then I'll go back to normal. Minus the coke"

"Good. 'Cause I think you'll go insane if not, man"

Yeah, that was probably true.

"Guys?"

His eyes rolled on their own when he saw Topper approaching. He really wasn't in the mood to deal with Topper. He never was lately. Topper used to be so funny to him, so so funny. Now that he was sober, he wasn't funny anymore. Funny how that worked.

"Hey, Top" Kelce greeted him with a smile "Aren't you supposed to be in college?"

"Oh, I'm taking a year off to learn from my grandfather. Gonna be a judge, like him"

"Good for you, Top"

"Judges do make a lot of money" Rafe agreed.

If he got to be one. It wasn't a sure thing, those studies were pretty hard. Or so he heard. He wouldn't know by experience, his one year in college was mostly about parties and drugs. And waking up without remembering what went down last night. That happened a lot.

"How's Sarah doing? Enjoying Pogue School?" There was some mock to his question that Rafe decided to pay attention to "Can't imagine it'll be easy to get into a good college from there"

"Sarah is going to Chapel Hill, like Ward and our mother did"

Topper showed his palm "Didn't mean any offense by saying that"

Yes, you did.

"None taken" he smiled tensely. Be civil. Be civil "Bye, Topper"

Something flashed through his face, disappointment of some kind. Rafe didn't care. It took a lot for him to actually care at times, and Topper almost never got him to care.

"Dude, you didn't need to be that rude. What went down between you two anyway?"

What, indeed. Nothing really, he simply bothered Sarah and in turn bothered Rafe. Lie. And, in addition, maybe he was a little jealous. Jealous that he got to be with Sarah, while he didn't.

"Nothing. Life, I guess"

Kelce hummed, the look on his eyes told him he didn't believe him. Of course he didn't. He knew him too much.

After having lunch with Kelce, Rafe went to pick up Sarah and Kie. But it wasn't only them he was picking up, apparently. Thank fuck he got the truck for that, because the Pogues inmediatly got in. Sarah on the passenger seat, and the rest on the back. JJ sat on the floor of the car due to lack of seats. He sighed.

"What are you all doing?"

"Sarah said we could come with you to Tannyhill" Pope answered, slightly kicking JJ who was at his feet "Right?"

"It's hot, dude, almost like it's summer. You have a pool"

"That's the global warming"

"Yeah, you said that like twenty times already, Kie"

"We live by the fucking ocean"

"Pools are cooler" JJ smiled "That's why they are making me one in my house. I'm going full kook, people!"

JJ chose to stay in that shithole that he grew up in, bought it from his father and remodeled the whole place.

"Right, and can't you buy a car for yourself? You're the king of spending"

"I'm not!"

"You do keep buying dumb shit" Pope side-eyed him "Why haven't you bought a car?"

"I bought a new bike. You're the one who keeps telling me not to spend all at once!"

"You're telling me that none of you bought a fucking car?"

Weren't poor people supposed to be practical? They sure weren't.

"I had the Twinkie fixed and bought a bike"

"I'm saving it"

He turned his head to look at Pope, a little incredulous.

"All of it"

Pope just shrugged "College is expensive"

"Not that expensive"

"Most people who win the lottery end up losing everything for making bad decisions with the money. I'm not risking it. I'll keep the money safe and use it only when it's needed"

"Fair enough" Rafe looked out of the window. The people were leaving the school grounds while they bickered "Alright, JJ and John B, grab your bikes and meet us in Tannyhill"

The two pogues stared at each other.

"Yeah, that's probably for the best"

"Good idea"

It didn't take them long to reach Tannyhill, John B and JJ following after him.

The Pogues made themselves right at home, like they usually did. Shit they even had clothes there, Kie specially. He didn't mind. Not really. It reminded him of the time when his mother lived. When Tannyhill was a vibrant place full of life and people. A better time.

Rafe laid down on his hammock, the winter sun warming his skin. It didn't burn, not like the summer sun, though he didn't doubt Kiara was right about the global warming. He definitely needed to invest in something to help with that, once he got the money from the fund his mother left.

JJ took a dive into the pool, splashing water all over Sarah and Kie and almost Pope who was holding a book.

"Be careful!" he shouted.

"Fucking hell, JJ!" Kie wiped the water off her face before frowning and jumping into the water herself "Come here!"

He turned his head to Sarah who laid on her hammock, listening to whatever John B was saying.

Fucking John B.

Rafe's eyes seemed to have a life of their own that day, glancing at Sarah's body. That bikini looked great on her. And that was definitely something he shouldn't be thinking about. That was his little sister. He held her when she was a baby. He told her bedtime stories. He played with her. He shouldn't be looking at her chest go up and down, and he definitely shouldn't be letting his eyes fall to her cleavage.

He swallowed and turned to Pope.

"What are you reading?"

"Dune" Pope raised his eyes from the book "Is a sci-fi novel, pretty good. You should read it"

"Oh" he knew that book. His mother used to have it on her nightstand. Had to be somewhere in the attic "I just might"

JJ laughed, Kie was on top of him, trying to push his head underwater.

"You guys know anything about your dad?" Pope put his book down "Like, how he's doing in prison"

"Nah. He hasn't tried to call me, I'm not surprised by that. He hates me"

"He has tried to call me a couple of times" Sarah commented as if it was the most natural thing in the world "I don't pick it up. I don't wanna talk to him"

And she never told him. Ward was calling her and she never mentioned. His jaw clenched.

After the Pogues left, Sarah felt as if the house was colder. Not because they left, but because Rafe was suddenly so distant. He didn't even look at her.

Wheezie called and said she was staying the night at Sandra's and that only made her feel worse.

Rafe had retreated to the office, the one that was Ward's but now was Rafe's. And honestly, Sarah couldn't stand the silence. She couldn't stand how cold he was now. How did she ever deal with it before?

"Do you want to tell me what's wrong?" she closed her arms over the oversized shirt she wore over her bikini "You are cold and silent. That's not you, Rafe"

He looked up from whatever document he had been reading.

"Why didn't you tell me Ward was calling you?"

Was that it? Was he jealous of the attention their father paid to her? Again? It wasn't her fault. She didn't mean for it to happen. She broke their relationship (No, it wasn't her. It was Ward), but that wasn't enough. Tears prickled at the corner of her eyes. When will it be enough for him?

"This again? Are you once again blaming me because dad is a piece of shit?!"

Rafe growled, slamming the table and standing up. She jumped back.

"No! I'm pissed because you didn't tell me!" In tree strides he crossed the room, stopping when he was close to her. So close she had to crane her neck to look at his face. So close, she could feel the warmth coming from his body "I'm angry, because we are supposed to be in this together, but you are keeping secrets"

Sarah shook her head, trying to blink away the tears.

"I'm not keeping secrets"

"Then why didn't you tell me?!"

"I didn't think it was necessary. We don't really talk about everything"

"Don't we?"

Now or never.

"We don't talk about what happened in the Bahamas" she whispered "Do you wanna talk about that?"

"No. I don't wanna talk"

His hand closed around the back of her neck, like she was a misbehaving puppy, and her heart jumped. Sarah let him pull her closer. She let him kiss her.

#outer banks#obx#outer banks fanfiction#obx fanfiction#rafe cameron#sarah cameron#rafe cameron fanfiction#sarah cameron fanfic#rafe and sarah#rafe x sarah#shipcest#tw: incest

29 notes

·

View notes

Text

Private equity ghouls have a new way to steal from their investors

Private equity is quite a racket. PE managers pile up other peoples’ money — pension funds, plutes, other pools of money — and then “invest” it (buying businesses, loading them with debt, cutting wages, lowering quality and setting traps for customers). For this, they get an annual fee — 2% — of the money they manage, and a bonus for any profits they make.

On top of this, private equity bosses get to use the carried interest tax loophole, a scam that lets them treat this ordinary income as a capital gain, so they can pay half the taxes that a working stiff would pay on a regular salary. If you don’t know much about carried interest, you might think it has to do with “interest” on a loan or a deposit, but it’s way weirder. “Carried interest” is a tax regime designed for 16th century sea captains and their “interest” in the cargo they “carried”:

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interest

Private equity is a cancer. Its profits come from buying productive firms, loading them with debt, abusing their suppliers, workers and customers, and driving them into ground, stiffing all of them — and the company’s creditors. The mafia have a name for this. They call it a “bust out”:

https://pluralistic.net/2023/06/02/plunderers/#farben

Private equity destroyed Toys R Us, Sears, Bed, Bath and Beyond, and many more companies beloved of Main Street, bled dry for Wall Street:

https://prospect.org/culture/books/2023-06-02-days-of-plunder-morgenson-rosner-ballou-review/

And they’re coming for more. PE funds are “rolling up” thousands of Boomer-owned business as their owners retire. There’s a good chance that every funeral home, pet groomer and urgent care clinic within an hour’s drive of you is owned by a single PE firm. There’s 2.9m more Boomer-owned businesses going up for sale in the coming years, with 32m employees, and PE is set to buy ’em all:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

PE funds get their money from “institutional investors.” It shouldn’t surprise you to learn they treat their investors no better than their creditors, nor the customers, employees or suppliers of the businesses they buy.

Pension funds, in particular, are the perennial suckers at the poker table. My parent’s pension fund, the Ontario Teachers’ Fund, are every grifter’s favorite patsy, losing $90m to Sam Bankman-Fried’s cryptocurrency scam:

https://www.otpp.com/en-ca/about-us/news-and-insights/2022/ontario-teachers--statement-on-ftx/

Pension funds are neck-deep in private equity, paying steep fees for shitty returns. Imagine knowing that the reason you can’t afford your apartment anymore is your pension fund gambled with the private equity firm that bought your building and jacked up the rent — and still lost money:

https://pluralistic.net/2020/02/25/pluralistic-your-daily-link-dose-25-feb-2020/

But there’s no depth too low for PE looters to sink to. They’ve found an exciting new way to steal from their investors, a scam called a “continuation fund.” Writing in his latest newsletter, the great Matt Levine breaks it down:

https://news.bloomberglaw.com/mergers-and-acquisitions/matt-levines-money-stuff-buyout-funds-buy-from-themselves

Here’s the deal: say you’re a PE guy who’s raised a $1b fund. That entitles you to a 2% annual “carry” on the fund: $20,000,000/year. But you’ve managed to buy and asset strip so many productive businesses that it’s now worth $5b. Your carry doesn’t go up fivefold. You could sell the company and collect your 20% commission — $800m — but you stop collecting that annual carry.

But what if you do both? Here’s how: you create a “continuation fund” — a fund that buys your old fund’s portfolio. Now you’ve got $5b under management and your carry quintuples, to $100m/year. Levine dryly notes that the FT calls this “a controversial type of transaction”:

https://www.ft.com/content/11549c33-b97d-468b-8990-e6fd64294f85

These deals “look like a pyramid scheme” — one fund flips its assets to another fund, with the same manager running both funds. It’s a way to make the pie bigger, but to decrease the share (in both real and proportional terms) going to the pension funds and other institutional investors who backed the fund.

A PE boss is supposed to be a fiduciary, with a legal requirement to do what’s best for their investors. But when the same PE manager is the buyer and the seller, and when the sale takes place without inviting any outside bidders, how can they possibly resolve their conflict of interest?

They can’t: 42% of continuation fund deals involve a sale at a value lower than the one that the PE fund told their investors the assets were worth. Now, this may sound weird — if a PE boss wants to set a high initial value for their fund in order to maximize their carry, why would they sell its assets to the new fund at a discount?

Here’s Levine’s theory: if you’re a PE guy going back to your investors for money to put in a new fund, you’re more likely to succeed if you can show that their getting a bargain. So you raise $1b, build it up to $5b, and then tell your investors they can buy the new fund for only $3b. Sure, they can get out — and lose big. Or they can take the deal, get the new fund at a 40% discount — and the PE boss gets $60m/year for the next ten years, instead of the $20m they were getting before the continuation fund deal.

PE is devouring the productive economy and making the world’s richest people even richer. The one bright light? The FTC and DoJ Antitrust Division just published new merger guidelines that would make the PE acquire/debt-load/asset-strip model illegal:

https://www.ftc.gov/news-events/news/press-releases/2023/07/ftc-doj-seek-comment-draft-merger-guidelines

The bad news is that some sneaky fuck just slipped a 20% FTC budget cut — $50m/year — into the new appropriations bill:

https://twitter.com/matthewstoller/status/1681830706488438785

They’re scared, and they’re fighting dirty.

I’m at San Diego Comic-Con!

Today (Jul 20) 16h: Signing, Tor Books booth #2802 (free advance copies of The Lost Cause — Nov 2023 — to the first 50 people!)

Tomorrow (Jul 21):

1030h: Wish They All Could be CA MCs, room 24ABC (panel)

12h: Signing, AA09

Sat, Jul 22 15h: The Worlds We Return To, room 23ABC (panel)

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/07/20/continuation-fraud/#buyout-groups

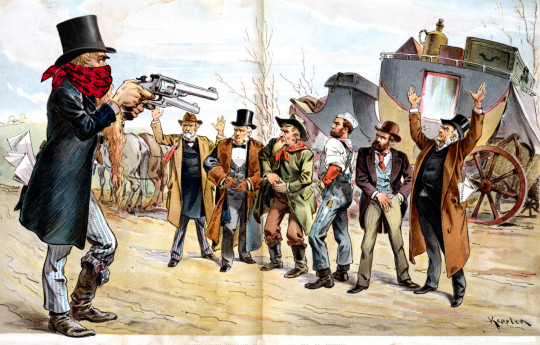

[Image ID: An old Punch editorial cartoon depicting a bank-robber sticking up a group of businesspeople and workers. He wears a bandanna emblazoned with dollar-signs and a top-hat.]

#pluralistic#buyout groups#continuation fraud#pe#pyramid schemes#the sucker at the table#pension plans#continuation funds#matt levine#fiduciaries#finance#private equity#mark to market#ripoffs

310 notes

·

View notes

Text

Toledo City Council just approved a plan to turn $1.6 million in public dollars into as much as $240 million in economic stimulus, targeted at some of the Ohio metro’s most vulnerable residents.

“It’s really going to help people put food on the table, help them pay their rent, help them pay their utilities,” says Toledo City Council Member Michele Grim, who led the way for the measure. “Hopefully we can prevent some evictions.”

The strategy couldn’t be simpler: It works by canceling millions in medical debt.

Working with the New York City-based nonprofit RIP Medical Debt, the City of Toledo and the surrounding Lucas County are chipping in $800,000 each out of their federal COVID-19 recovery funds from the American Rescue Plan Act.

The combined $1.6 million in funding is enough for RIP Medical Debt to acquire and cancel up to $240 million in medical debt owed by Lucas County households that earn up to 400% of the federal poverty line.

“It could be more than a one-to-100 return on investment of government dollars,” Grim says. “I really can’t think of a more simple program for economic recovery or a better way of using American Rescue Plan dollars, because it’s supposed to rescue Americans.”

How It Works

Under the RIP Medical Debt model, there is no application process to cancel medical debt. The nonprofit negotiates directly with local hospitals or hospital systems one-by-one, purchasing portfolios of debt owed by eligible households and canceling the entire portfolio en masse.

“One day someone will get a letter saying your debt’s been canceled,” Grim says. It’s a simple strategy for economic welfare and recovery.

RIP Medical Debt was founded in 2014 by a pair of former debt collection agents, and since inception it has acquired and canceled more than $7.3 billion in medical debt owed by 4.2 million households — an average of $1,737 per household...

Local Governments Get Involved

The partnership with Toledo and Lucas County is the third instance of the public sector funding RIP Medical Debt to cancel debt portfolios.

Earlier this year, in the largest such example yet, the Cook County Board of Commissioners approved a plan to provide $12 million in ARPA funds for RIP Medical Debt to purchase and cancel an estimated $1 billion in medical debt held by hospitals across Cook County, which includes Chicago.

“Governments contract with nonprofits all the time for various social interventions,” Sesso says.

“This isn’t really that far-fetched or different from that. I would say between five and 10 other local governments have reached out just since the Toledo story came out.”

What's the Deal with Medical Debt?

An estimated one in five households across the U.S. have some amount of medical debt, and they are disproportionately Black and Latino, according to the U.S. Census Bureau...

Acquiring medical debt is relatively cheap: hospitals that sell medical debt portfolios do so for just pennies on the dollar, usually to investors on the secondary market.

The purchase price is so low because hospitals and debt buyers alike know that medical debt is the hardest form to collect...

The amount of debt canceled for any given household has ranged from $25 all the way up to six-figure amounts. Under IRS regulations, debts canceled under RIP Medical Debt’s model do not count as taxable income for households...

Massive Expansion Coming Up

After not one but two donations from philanthropist MacKenzie Scott, totaling $80 million, RIP Medical Debt is planning for expansion.

It’s using a portion of those dollars to create an internal revolving line of credit to expand to places where it can find willing sellers before it has found willing funders.

The internal line of credit means the nonprofit now has new, albeit still limited, flexibility to acquire debt portfolios from hospitals first, then begin raising private or public dollars locally to replenish the line of credit later and make those funds available for other locations.

“People often ask, do you only work with nonprofit hospitals, or do you work with for-profit hospitals? And I’m like, I just want to get the debt, regardless of who created the debt. If it’s out there, I want it,” Sesso says.

Fundamentally, they are not solving the issue of medical debt, but easing its pressure from as many lives as possible — while also upping the pressure on lawmakers and the healthcare industry.

“We’re intentionally taking the stories of the individuals whose debt we have resolved, and putting their stories out into the world with intention in a way that tries to push and create more of that pressure to fundamentally solve the problem,” she says.

-via GoodGoodGood, 4/6/23

#toledo#ohio#chicago#cook county#new york#medical debt#healthcare#healthcare access#united states#us politics#debt crisis#debt relief#hospital#nonprofit#good news#hope

303 notes

·

View notes

Text

How the Neocons Subverted Russia’s Financial Stabilization in the Early 1990s

by Jeffrey Sachs

In 1989 I served as an advisor to the first post-communist government of Poland, and helped to devise a strategy of financial stabilization and economic transformation. My recommendations in 1989 called for large-scale Western financial support for Poland’s economy in order to prevent a runaway inflation, enable a convertible Polish currency at a stable exchange rate, and an opening of trade and investment with the countries of the European Community (now the European Union). These recommendations were heeded by the US Government, the G7, and the International Monetary Fund.

Based on my advice, a $1 billion Zloty stabilization fund was established that served as the backing of Poland’s newly convertible currency. Poland was granted a standstill on debt servicing on the Soviet-era debt, and then a partial cancellation of that debt. Poland was granted significant development assistance in the form of grants and loans by the official international community.

Poland’s subsequent economic and social performance speaks for itself. Despite Poland’s economy having experienced a decade of collapse in the 1980s, Poland began a period of rapid economic growth in the early 1990s. The currency remained stable and inflation low. In 1990, Poland’s GDP per capita (measured in purchasing-power terms) was 33% of neighboring Germany. By 2024, it had reached 68% of Germany’s GDP per capita, following decades of rapid economic growth.

On the basis of Poland’s economic success, I was contacted in 1990 by Mr. Grigory Yavlinsky, economic advisor to President Mikhail Gorbachev, to offer similar advice to the Soviet Union, and in particular to help mobilize financial support for the economic stabilization and transformation of the Soviet Union. One outcome of that work was a 1991 project undertaken at the Harvard Kennedy School with Professors Graham Allison, Stanley Fisher, and Robert Blackwill. We jointly proposed a “Grand Bargain” to the US, G7, and Soviet Union, in which we advocated large-scale financial support by the US and G7 countries for Gorbachev’s ongoing economic and political reforms. The report was published as Window of Opportunity: The Grand Bargain for Democracy in the Soviet Union (1 October 1991).

The proposal for large-scale Western support for the Soviet Union was flatly rejected by the Cold Warriors in the White House. Gorbachev came to the G7 Summit in London in July 1991 asking for financial assistance, but left empty-handed. Upon his return to Moscow, he was abducted in the coup attempt of August 1991. At that point, Boris Yeltsin, President of the Russian Federation, assumed effective leadership of the crisis-ridden Soviet Union. By December, under the weight of decisions by Russia and other Soviet republics, the Soviet Union was dissolved with the emergence of 15 newly independent nations.

In September 1991, I was contacted by Yegor Gaidar, economic advisor to Yeltsin, and soon to be acting Prime Minister of newly independent Russian Federation as of December 1991. He requested that I come to Moscow to discuss the economic crisis and ways to stabilize the Russian economy. At that stage, Russia was on the verge of hyperinflation, financial default to the West, the collapse of international trade with the other republics and with the former socialist countries of Eastern Europe, and intense shortages of food in Russian cities resulting from the collapse of food deliveries from the farmlands and the pervasive black marketing of foodstuffs and other essential commodities.

I recommended that Russia reiterate the call for large-scale Western financial assistance, including an immediate standstill on debt servicing, longer-term debt relief, a currency stabilization fund for the ruble (as for the Zloty in Poland), large-scale grants of dollars and European currencies to support urgently needed food and medical imports and other essential commodity flows, and immediate financing by the IMF, World Bank, and other institutions to protect Russia’s social services (healthcare, education, and others).

In November 1991, Gaidar met with the G7 Deputies (the deputy finance ministers of the G7 countries) and requested a standstill on debt servicing. This request was flatly denied. To the contrary, Gaidar was told that unless Russia continued to service every last dollar as it came due, emergency food aid on the high seas heading to Russia would be immediately turned around and sent back to the home ports. I met with an ashen-faced Gaidar immediately after the G7 Deputies meeting.

In December 1991, I met with Yeltsin in the Kremlin to brief him on Russia’s financial crisis and on my continued hope and advocacy for emergency Western assistance, especially as Russia was now emerging as an independent, democratic nation after the end of the Soviet Union. He requested that I serve as an advisor to his economic team, with a focus on attempting to mobilize the needed large-scale financial support. I accepted that challenge and the advisory position on a strictly unpaid basis.

Upon returning from Moscow, I went to Washington to reiterate my call for a debt standstill, a currency stabilization fund, and emergency financial support. In my meeting with Mr. Richard Erb, Deputy Managing Director of the IMF in charge of overall relations with Russia, I learned that the US did not support this kind of financial package. I once again pleaded the economic and financial case, and was determined to change US policy. It had been my experience in other advisory contexts that it might require several months to sway Washington on its policy approach.

Indeed, during 1991-94 I would advocate non-stop but without success for large-scale Western support for Russia’s crisis-ridden economy, and support for the other 14 newly independent states of the former Soviet Union. I made these appeals in countless speeches, meetings, conferences, op-eds, and academic articles. Mine was a lonely voice in the US in calling for such support. I had learned from economic history — most importantly the crucial writings of John Maynard Keynes (especially Economic Consequences of the Peace, 1919) — and from my own advisory experiences in Latin America and Eastern Europe, that external financial support for Russia could well be the make or break of Russia’s urgently needed stabilization effort.

It is worth quoting at length here from my article in the Washington Post in November 1991 to present the gist of my argument at the time:

This is the third time in this century in which the West must address the vanquished. When the German and Hapsburg Empires collapsed after World War I, the result was financial chaos and social dislocation. Keynes predicted in 1919 that this utter collapse in Germany and Austria, combined with a lack of vision from the victors, would conspire to produce a furious backlash towards military dictatorship in Central Europe. Even as brilliant a finance minister as Joseph Schumpeter in Austria could not stanch the torrent towards hyperinflation and hyper-nationalism, and the United States descended into the isolationism of the 1920s under the "leadership" of Warren G. Harding and Sen. Henry Cabot Lodge. After World War II, the victors were smarter. Harry Truman called for U.S. financial support to Germany and Japan, as well as the rest of Western Europe. The sums involved in the Marshall Plan, equal to a few percent of the recipient countries' GNPs, was not enough to actually rebuild Europe. It was, though, a political lifeline to the visionary builders of democratic capitalism in postwar Europe. Now the Cold War and the collapse of communism have left Russia as prostrate, frightened and unstable as was Germany after World War I and World War II. Inside Russia, Western aid would have the galvanizing psychological and political effect that the Marshall Plan had for Western Europe. Russia's psyche has been tormented by 1,000 years of brutal invasions, stretching from Genghis Khan to Napoleon and Hitler. Churchill judged that the Marshall Plan was history's "most unsordid act," and his view was shared by millions of Europeans for whom the aid was the first glimpse of hope in a collapsed world. In a collapsed Soviet Union, we have a remarkable opportunity to raise the hopes of the Russian people through an act of international understanding. The West can now inspire the Russian people with another unsordid act.

This advice went unheeded, but that did not deter me from continuing my advocacy. In early 1992, I was invited to make the case on the PBS news show The McNeil-Lehrer Report. I was on air with acting Secretary of State Lawrence Eagleburger. After the show, he asked me to ride with him from the PBS studio in Arlington, Virginia back to Washington, D.C. Our conversation was the following. “Jeffrey, please let me explain to you that your request for large-scale aid is not going to happen. Even assuming that I agree with your arguments — and Poland’s finance minister [Leszek Balcerowicz] made the same points to me just last week — it’s not going to happen. Do you want to know why? Do you know what this year is?” “1992,” I answered. “Do you know that this means?” “An election year?” I replied. “Yes, this is an election year. It’s not going to happen.”

Russia’s economic crisis worsened rapidly in 1992. Gaidar lifted price controls at the start of 1992, not as some purported miracle cure but because the Soviet-era official fixed prices were irrelevant under the pressures of the black markets, the repressed inflation (that is, rapid inflation in the black-market prices and therefore the rising the gap with the official prices), the complete breakdown of the Soviet-era planning mechanism, and the massive corruption engendered by the few goods still being exchanged at the official prices far below the black-market prices.

Russia urgently needed a stabilization plan of the kind that Poland had undertaken, but such a plan was out of reach financially (because of the lack of external support) and politically (because the lack of external support also meant the lack of any internal consensus on what to do). The crisis was compounded by the collapse of trade among the newly independent post-Soviet nations and the collapse of trade between the former Soviet Union and its former satellite nations in Central and Eastern Europe, which were now receiving Western aid and were reorienting trade towards Western Europe and away from the former Soviet Union.

During 1992 I continued without any success to try to mobilize the large-scale Western financing that I believed to be ever-more urgent. I pinned my hopes on the newly elected Presidency of Bill Clinton. These hopes too were quickly dashed. Clinton’s key advisor on Russia, Johns Hopkins Professor Michael Mandelbaum, told me privately in November 1992 that the incoming Clinton team had rejected the concept of large-scale assistance for Russia. Mandelbaum soon announced publicly that he would not serve in the new administration. I met with Clinton’s new Russia advisor, Strobe Talbott, but discovered that he was largely unaware of the pressing economic realities. He asked me to send him some materials about hyperinflations, which I duly did.

At the end of 1992, after one year of trying to help Russia, I told Gaidar that I would step aside as my recommendations were not heeded in Washington or the European capitals. Yet around Christmas Day I received a phone call from Russia’s incoming financing minister, Mr. Boris Fyodorov. He asked me to meet him in Washington in the very first days of 1993. We met at the World Bank. Fyodorov, a gentleman and highly intelligent expert who tragically died young a few years later, implored me to remain as an advisor to him during 1993. I agreed to do so, and spent one more year attempting to help Russia implement a stabilization plan. I resigned in December 1993, and publicly announced my departure as advisor in the first days of 1994.

My continued advocacy in Washington once again fell on deaf ears in the first year of the Clinton Administration, and my own forebodings became greater. I repeatedly invoked the warnings of history in my public speaking and writing, as in this piece in the New Republic in January 1994, soon after I had stepped aside from the advisory role.

Above all, Clinton should not console himself with the thought that nothing too serious can happen in Russia. Many Western policymakers have confidently predicted that if the reformers leave now, they will be back in a year, after the Communists once again prove themselves unable to govern. This might happen, but chances are it will not. History has probably given the Clinton administration one chance for bringing Russia back from the brink; and it reveals an alarmingly simple pattern. The moderate Girondists did not follow Robespierre back into power. With rampant inflation, social disarray and falling living standards, revolutionary France opted for Napoleon instead. In revolutionary Russia, Aleksandr Kerensky did not return to power after Lenin's policies and civil war had led to hyperinflation. The disarray of the early 1920s opened the way for Stalin's rise to power. Nor was Bruning'sgovernment given another chance in Germany once Hitler came to power in 1933.

It is worth clarifying that my advisory role in Russia was limited to macroeconomic stabilization and international financing. I was not involved in Russia’s privatization program which took shape during 1993-4, nor in the various measures and programs (such as the notorious “shares-for-loans” scheme in 1996) that gave rise to the new Russian oligarchs. On the contrary, I opposed the various kinds of measures that Russia was undertaking, believing them to be rife with unfairness and corruption. I said as much in both the public and in private to Clinton officials, but they were not listening to me on that account either. Colleagues of mine at Harvard were involved in the privatization work, but they assiduously kept me far away from their work. Two were later charged by the US government with insider dealing in activities in Russia which I had absolutely no foreknowledge or involvement of any kind. My only role in that matter was to dismiss them from the Harvard Institute for International Development for violating the internal HIID rules against conflicts of interest in countries that HIID advised.

The failure of the West to provide large-scale and timely financial support to Russia and the other newly independent nations of the former Soviet Union definitely exacerbated the serious economic and financial crisis that faced those countries in the early 1990s. Inflation remained very high for several years. Trade and hence economic recovery were seriously impeded. Corruption flourished under the policies of parceling out valuable state assets to private hands.

All of these dislocations gravely weakened the public trust in the new governments of the region and the West. This collapse in social trust brought to my mind at the time the adage of Keynes in 1919, following the disaster Versailles settlement and the hyperinflations that followed: “There is no subtler, no surer means of over- turning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and it does it in a manner which not one man in a million is able to diagnose.”

During the tumultuous decade of the 1990s, Russia’s social services fell into decline. When this decline was coupled with the greatly increased stresses on society, the result was a sharp rise in Russia’s alcohol-related deaths. Whereas in Poland, the economic reforms were accompanied by a rise in life expectancy and public health, the very opposite occurred in crisis-riven Russia.

Even with all of these economic debacles, and with Russia’s default in 1998, the grave economic crisis and lack of Western support were not the definitive breaking points of US-Russian relations. In 1999, when Vladimir Putin became Prime Minister and in 2000 when he became President, Putin sought friendly and mutually supportive international relations between Russia and the West. Many European leaders, for example, Italy’s Romano Prodi, have spoken extensively about Putin’s goodwill and positive intentions towards strong Russia-EU relations in the first years of his presidency.

It was in military affairs rather than in economics that the Russian – Western relations ended up falling apart in the 2000s. As with finance, the West was militarily dominant in the 1990s, and certainly had the means to promote strong and positive relations with Russia. Yet the US was far more interested in Russia’s subservience to NATO that it was in stable relations with Russia.